Valuing an Estate

Estate valuation is one of the most important tasks facing an executor or personal representative. The valuation of the estate provides you with much of the information you need to fill out probate forms and – crucially – helps you to work out how large an Inheritance Tax bill there will be to pay.

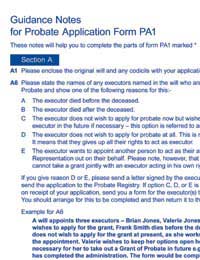

To begin with, it is important to note that it is generally only the executor or personal representative that will be allowed to value an estate. You will not normally be able to access details of the assets held by the deceased individual until you have a grant of probate, or a ‘confirmation’ in Scotland. A grant of probate can be applied for by filling in Probate Application Form PA1.

Market Value of a Deceased Person's Estate

Having received the grant of probate, you must then begin the process of valuation. The key principle to keep in mind is that all assets must be valued according to the price they would achieve if they were to be sold on the open market at the time of death. This may mean that you have to have some assets professionally valued; for example, property prices will probably have to be judged by a chartered surveyor.You will also have to factor in any debts owed by the estate of the deceased individual. You should be able to request this information once you have a grant of probate; the individual’s creditors will be able to tell you how much remains to be paid. Alternatively, you may be able to find details in the individual’s documents. Debts should be deducted from the total value of assets you have calculated.

Throughout the process you should ensure that you are keeping sufficient records. You should individually detail all the assets and debts that you find – not just the totals. This will be vital if there is any confusion or argument over the valuation process.

Inheritance Tax and Excepted Estates

Having valued the estate and deducted the debts, you will be able to calculate whether or not Inheritance Tax is due. The Inheritance Tax threshold for the 2009-10 tax year is £325,000; this means that if the total value of the estate, minus any debts, is greater than this amount you will have to pay Inheritance Tax.When valuing an estate you may know that IHT will not be payable before you begin. This is known as taking control of an ‘excepted estate’. In these cases you will need to fill in Inheritance Tax form IHT205, and send this to the Probate Office with PA1 (the form mentioned earlier in the article). You will also need to pay a fee; this is currently set at £90, and is detailed in form PA1. You will then be invited to attend an interview with a Probate Officer before an application for a grant of probate is approved.

There are many companies offering probate valuation services. You may consider taking advantage of these services, particularly if the affairs of the deceased individual were complex. You should remember, though, that these services are normally charged as a percentage of the total value of the estate, with a minimum charge. It is therefore important that you understand the costs before you begin.

Re: Will Inheritance Affect My Council Tenancy?

Im facing similar situation. Inheritence only enough to buy foreign property, agricultural holding, or derelict…

Re: Inheriting Property

Am I allow to get housing benefit on my mums property till its sold?even though I will eventually be entitled to 25%of the sale

Re: Inheriting Property

Am I allow to get housing benefit on my mums property till its sold?even though I will eventually be entitled to 25%of the sae

Re: Will Inheritance Affect My Council Tenancy?

I am living in temporary council accommodation and due to illness am receiving PIP plus Universal Credit. I am…

Re: Will Inheritance Affect My Council Tenancy?

I’m a council tenant my died and left a flat over 55 to live in that buliding to me how’s do I go ambition…

Re: Will Inheritance Affect My Council Tenancy?

I doubt this will be answered as I can’t see any answers to anyone else’s comments but here goes My mum wants…

Re: Will Inheritance Affect My Council Tenancy?

I have inherited property from my mother in law, as we live in council property could we rent the inherited…

Re: Will Inheritance Affect My Council Tenancy?

Assured social housing tenant (SH), lone parent recently deceased leaving an estate including a 3 bedroom…

Re: Will Inheritance Affect My Council Tenancy?

My disabled son lives in a council flat and receives benefits, including PIP. How could I arrange for him to…

Re: Will Inheritance Affect My Council Tenancy?

me and my brother are set to inherit 2 propertys but we have council flats. will we loose our rights to council…